THE CASE:

I am 28 years old and have been investing in NPS since 2016, and that is my retirement kitty. I aspire to buy a house in 20 years (current cost- Rs. 1.cr). So how much would I need in 20 years?

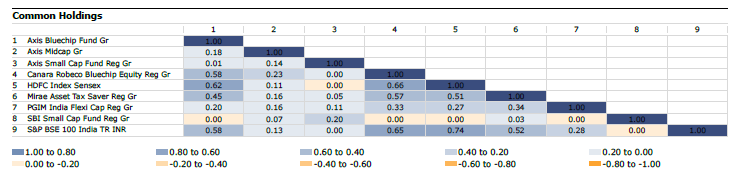

I am planning to start monthly SIPs: Rs 3,000 each in Canara Robeco Bluechip Equity, Mirae Asset Tax Saver, HDFC Index Sensex, PGIM India Diversified Equity / Rs 2,000 each in Axis Mid Cap, Axis Small Cap, SBI Small Cap / Rs 4,000 in Axis Bluechip. Are these 8 funds sufficient for diversification?

THE SOLUTION

- A monthly SIP of Rs 22,000/month for 20 years would result in a corpus of Rs 1.5cr at the end of 20 years, if we assume a return of 10% per annum. This is equal to the current cost of the flat. But the cost of the apartment would increase over this time. So not only do you have to invest regularly, but you must keep increasing it as often as possible.

- You have started investing early so you have time on your side. Your current monthly SIP is Rs 22,000. Increase it by at least 15% every year. It is important to invest as much as possible early on, which will truly help you compound your wealth over the longer term.

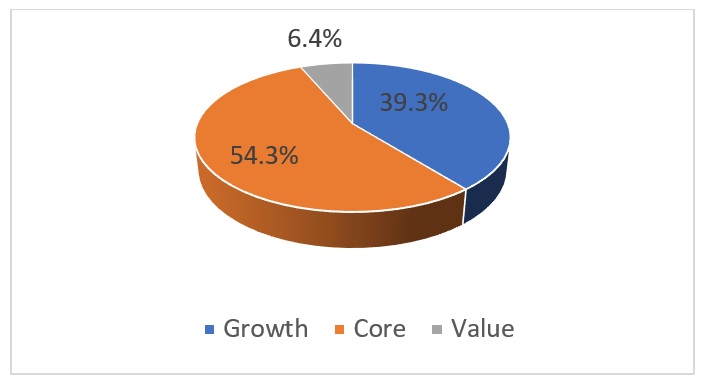

- While your portfolio is fine, introducing a fund with value bias would help aid greater diversification and build a portfolio that’s can do well over market cycles.

Portfolio overview

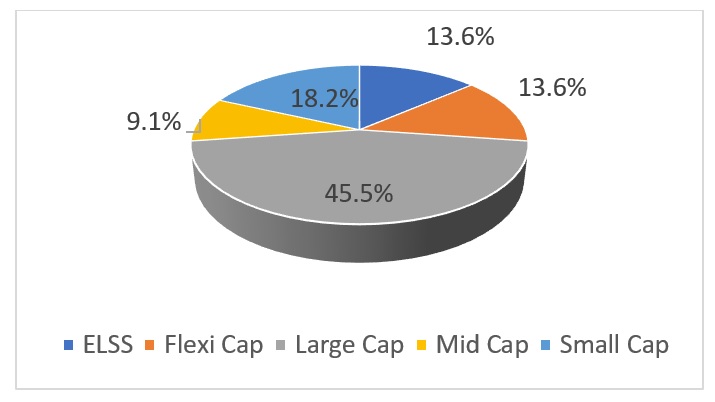

Portfolio: Fund category

Portfolio: Market cap of underlying holdings

Portfolio: Style of underlying holdings

Portfolio: Overlap between fund holdings

Data source: Morningstar