THE CASE:

I have mutual fund SIPs – SBI blue chip rs 5000 From 2 years, Parag parikh rs 5000 From 1 year, Nippon india large cap 3000 From 5 years, Nippon india mid cap 3000 From 3 years, More asset multicap 35 fund 1000 from 2 years. Target 10 years pl suggest any changes.

THE SOLUTION:

In absence of details like your age, personal & financial data, and risk tolerance level, any analysis will be extremely limited and may not be fully justifiable. The ideal mix of different assets plays a pivotal role in optimising a portfolio. Targeting high returns should not be the only criteria for investment selection.

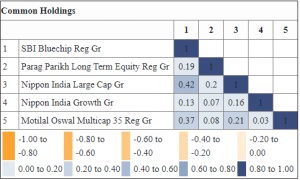

On your above mix of funds, overlapping of stocks are within acceptable range except SBI bluechip and Nippon Large that is 42% and SBI bluechip and Mos Multicap 35 that is 37% – both slightly higher.

To evaluate mutual funds across categories, one can look at the performance charts and the analysis of select funds.

DIRECT plans instead of REGULAR plans will fetch better returns in comparison.

Shift allocation from equity to debt when you are 2-3 years of approaching your goal. Factor in the inflation to your goal cost to see whether the expected corpus will meet the target in 10 years’ time.

Disclaimer: The above may not be the only solution and there could be multiple solutions for the same case. This is only a case study and should not be construed as any kind of advice. Personal and financial situations differ for each individual. Please consult a qualified licensed professional advisor before taking any action.

For more case studies, click on tag ‘CASE STUDY’ shown below.