Senior citizens account for nearly 50 per cent of the total deaths (5,598) caused by the novel Corona Virus Disease-related (COVID-19) in India, as on June 2 and as per the Union Health Ministry’s data. The elderly make up just 10 per cent of the country’s population. This apart, individuals with co-morbidities – existing ailments or conditions – made up 73 per cent of the COVID-19 deaths in the country. Clearly, as is the global trend, COVID-19 impact hits the seniors the hardest. And it gets worse for those with pre-existing diseases. So, how must the elderly go about buying a health cover?

Choose better features over cheaper premium

The risks posed by the pandemic have pushed up the minimum sum insured needed for metros, across age-groups, but especially for senior citizens. “Nothing less than Rs 10 lakh will be ideal in this situation, when private hospitals are billing patients upwards of Rs 5 lakhs for the COVID-19 treatment, including the ventilator,” says Gurdeep Singh Batra, Head, Retail Underwriting, Bajaj Allianz General. Till recently, a Rs 5-lakh cover was considered sufficient to start with. “Going forward, Rs 10 lakh cover will become the new norm,” says Batra.

You could still keep your premiums low. Buy a regular policy for Rs 3-5 lakh, and then choose an add-on – a top up cover – to enhance the overall coverage. A top-up cover kicks in, only if your hospital bills are over and above the deductible amount. Hence, premiums are cheaper. So, if you have a base cover of Rs 3 lakh and you buy a top-up policy, the latter pays you only for bills that exceed Rs 3 lakh.

Pay attention to the terminology while zeroing in on such top-ups – a super top-up will take into account aggregate claims made during the year while ascertaining whether you have crossed the deductible threshold or not. On the other hand, a plain top-up will be activated only if your single claim exceeds the deductible limit. A super top-up is a more favourable concept, and more so for senior citizens, as their chances of being hospitalised more than once during the year are higher.

Are senior citizens’ health policies any good?

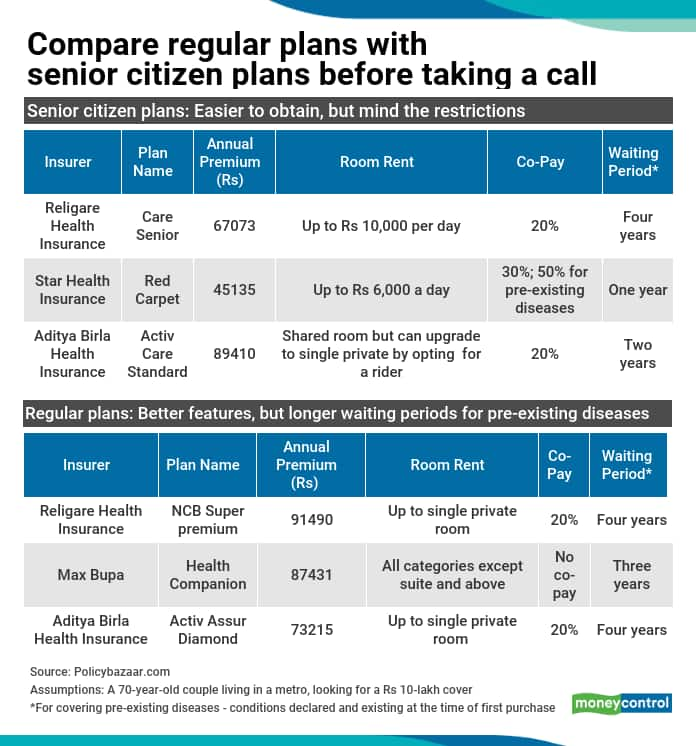

Non-life insurers such as New India Assurance, Star Health and Allied Insurance, Bajaj Allianz, Aditya Birla Health and HDFC ERGO offer specialised senior citizen policies. Unlike regular policies, these are offered to those over the age of 65. Despite your advanced age, the chances of an insurer issuing a senior policy are far higher than in the case of a regular policy. This is because dedicated plans would have factored in age-related risks. “Regular plans come with many stipulations, which include stringent medical tests, higher co-payment, explicit exclusions, and longer waiting periods for those with pre-existing diseases. Therefore, choosing a separate plan for senior citizens is a must,” says Mayank Bathwal, CEO, Aditya Birla Health Insurance.

The waiting period (before pre-existing illnesses are covered) in pre-existing policies for senior citizens’ covers is shorter (around a year) than regular plans (where it is around 3-4 years). COVID-19, not being a pre-existing disease, will be covered within these policies after 30 days.

On the flipside, these policies could come with co-pay and disease-wise capping, depending on the insurer. For example, Aditya Birla Health’s Active Care mandates a co-pay of 20 per cent, as does though it can be waived after payment of additional premium. New India’s Sixty Plus allows you to choose a sum insured of Rs 5 lakh, maximum eligible claim amount for major spinal surgeries and cancer surgeries will be limited to Rs 2 lakh and Rs 2.75 lakh.

Look for a regular cover first, but if it is not issued or carries prohibitively high premiums, explore dedicated policies. You could look at buying defined benefit critical illness policies, where a lump-sum is handed out in the event of diagnosis of listed ailments, to supplement the co-pay ratios or disease-wise capping, if any.

Use your corporate policy, but have one on your own too

Many work places do not extend insurance benefits to our parents. While some have done away with it entirely, others provide the cover if the employee bears the premium cost. If you have the option of covering your parents under the group policy, settle for the arrangement even if you have to pay from your pocket. The claim process is typically hassle-free in a group policy, but more importantly, your parents will be covered from day one for pre-existing illnesses too. If your employer offers a voluntary top-up cover, buy that one too, to ensure coverage for rising hospitalisation costs. You can also migrate to the same insurer’s retail policy at the time of switching jobs.

“However, you should still buy an independent cover for your parents. Your corporate cover could cease to exist if you leave the organisation. Even though migration facility is available, policy issuance is at the insurer’s discretion and your application could be rejected too,” advises Mehta.

When you are close to retirement, check if you can migrate your office insurance cover to your own cover. “This ensures you have a cover in your retirement from day one,” says Dr S Prakash, Managing Director, Star Health and Allied Insurance.

Even if your parents are, say, in the age-group of 60-64 and can be covered under your family floater plan, it’s best to buy a separate policy for them. They are more likely to have recurring and higher claims, leaving little balance sum insured for the rest of the family.

Getting an insurance policy for seniors has been tough in this lockdown. Tele-medical check-ups are not easily extended to senior citizens. That is why it’s always better to buy a policy as early as possible in life. The older you are, the more difficult it is to obtain a regular policy with fewer restrictions, and at a reasonable premium.

Finally, don’t forget to build a dedicated health corpus equal to at least ten per cent of your emergency kitty. This will take care of all the exclusions – expenses that insurer will not pay for – in a health policy.

Source: Moneycontrol