Long-term capital gain is the gain that is derived out of a sale of an asset (Land or Building or both) that has been held for more than two years. You can invest the gain in in 54EC Capital Gains bonds to claim tax exemption within 6 months of the date of sale of the asset. With effect from 1st April 2019, the lock-in period is increased to 5 years from 3 years.

As on date, there are four entities (all ‘AAA’ rated) which are empowered to issue Capital Gain Bonds: Power Finance Corporation Limited (PFC), Indian Railway Finance Corporation Limited, National Highways Authority of India, and Rural Electrification Corporation Limited.

Key Features of Capital Gain Bonds specified under Section 54EC:

- Non-transferable and non-negotiable bonds.

- No TDS but interest earned is taxable.

- AAA credit rating by ICRA, CRISIL and India Ratings and Research Private Limited

- Maximum investment is Rs. 50 lakhs. However, in case of joint holding, each owner has a separate limit of up to Rs 50 lakh for investing in these bonds.

5. Maximum of 500 bonds can be bought at Rs. 10000 per bond. - Annual interest rate at 5.75%.

- Tenure of the bond is 5 years.

- Available in Physical as well as demat form.

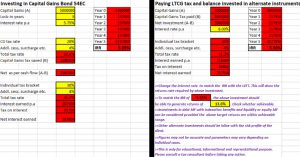

What makes sense – whether to invest in CG bonds and save tax or pay tax and invest balance in other alternate instruments. Let’s check.

If you invest in 54EC bonds, it will fetch a return of 5.75% p.a. (which will be taxable at the applicable slab rate of the taxpayer) but one will be able to save LTCG tax of Rs. 10,40,000 (LTCG rate of 20.8%). Thus, the effective post-tax return works out at 9.35% (considering the highest marginal tax rate of 31.2%).

If you pay LTCG tax and invest the net amount of Rs. 39,60,000 (Capital Gain of Rs. 50,00,000 – LTCG of Rs. 10,40,000) in other alternate instruments, for earning the same post-tax return of 9.35%, it would need to generate returns of around 13.6%.

Investments in debt MF with indexation benefits and liquidity or equity MF can be considered provided the above target returns from alternate instruments are within achievable range.

Alternate investments should be in line with your financial risk profile.

Calculations will vary depending on individual cases and changing parameters. Therefore, it is advisable to check and see what makes sense to YOU – whether to invest LT capital gains in 54EC bonds or pay LTCG tax and invest the balance in other alternate instruments.